Click & Download to read as PDF !

Earnings Season Gets Underway

Every few months, you may hear the phrase “earnings season” as you listen to financial news.

But what exactly is “earnings season,” and why is it important to Wall Street?

Earnings season is the time when a majority of publicly traded companies release their quarterly financial reports. Companies often go into great detail about their business, and some may guide what lies ahead.

Typically, earnings season starts several weeks after the calendar quarter comes to a close. For example, the fourth quarter’s earnings season began in mid-January, and the majority of companies expect to release their earnings over the next six weeks.1

In recent weeks, some market watchers have expressed concerns about stock-price valuations. Stocks are currently trading at about 23 times 2021 earnings, above the historical range of 15 to 17 times forward earnings.2

Expectations for a robust economic rebound may explain today’s valuations; a rise in corporate earnings may accompany these. As earnings season gathers momentum, we’ll be able to see if the optimism is warranted.3

Over the next few weeks, you can expect to hear some upbeat comments about the fourth quarter, but brace yourself for some negative reports. If you hear some confusing commentary, please give us a call. We’d welcome the chance to talk about what earnings are saying about the overall economic outlook.

Citations

1. Insights.FactSet.com, January 22, 2021

2. CNBC.com, January 21, 2021

3. Insights.FactSet.com, January 22, 2021

Outlook 2021: Bond Prices

The 10-year Treasury yield has climbed higher since the New Year, which means that some bond prices are dropping. You may have seen the headlines that say, “10-Year Yields Over 1%.”

For some, the first time they experience a change in bond prices is when they open their monthly statement and review their investments.

But before you check your January statement, here is some background that may help put the most recent move in rates in perspective.

The interest rate on the 10-year Treasury dropped steadily in the first half of 2020 and bottomed at 0.54% in late July. While rates remain at historic low levels, the yield on the 10-Year Treasury has doubled in the past six months. That’s a significant increase in a relatively short period of time. The recent rally that pushed the yield over 1% has drawn the most attention.1

Why are rates going higher? Even with the Federal Reserve holding short-term rates near zero, yields on longer-term bonds can move higher as the economy begins to improve and inflation expectations rise.2

Will bond yields keep going higher? A lot may depend on the path of the virus, vaccine distribution, and what’s next with additional stimulus money.3

Bonds can play an important part in any portfolio, but like any investment, periods of volatility are expected. If you’re concerned about the outlook for bonds, or the macro-economic trends behind the bond market’s rally, please give us a call. We’d welcome the chance to hear your perspective, and hopefully, we can provide some guidance.

Citations

1. Finance.Yahoo.com, January 18, 2021

2. CNBC.com, January 12, 2021

3. CNBC.com, January 7, 2021

Navigating Your Required Minimum Distribution

As much as you would like to, you can’t keep your money in your retirement account forever.

These investment vehicles include 401(k)s, IRAs, and similar retirement accounts.1 Under the SECURE Act, once you reach age 72, you must begin taking required minimum distributions from your 401(k), IRAs, or other defined contribution plans in most circumstances. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

Another major change that occurred from the SECURE Act is the removal of the age limit for traditional IRA contributions. Before the SECURE Act, you had to stop making contributions at age 70½. Now, you can continue to make contributions as long as you meet the earned-income requirement.2

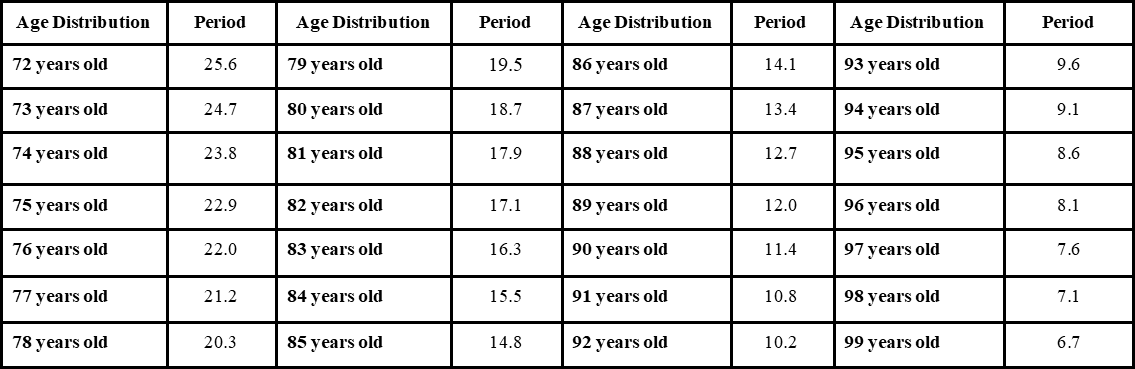

How do you determine how much your RMD needs to be? It depends on whether or not you’re married, and if you are, if your spouse is the sole beneficiary of your IRA and less than 10 years younger than you are. For everyone else, the Uniform Lifetime Table can help.

Keep in mind that this article is for informational purposes only, and the table below is meant to provide some guidance. The table is neither a recommendation nor a replacement for real-life advice. Always contact your tax, legal, or financial professional before making any changes to your required minimum distributions.

Uniform Lifetime Table (additional ages can be found on IRS.gov)

You can use the following formula to calculate a rough estimate of your RMD:

1. Determine the account balance as of December 31 of the previous year.

2. Find your age on the table and note the distribution period number.

3. Divide the total balance of your account by the distribution period. For example, say you’re 72, and your account balance is $100,000. Your RMD may be about $3,906, based on the table.

Calculating your RMD isn’t tricky, but understanding your RMD’s role in your overall retirement strategy can be complicated. It’s important to note that penalties can apply if you don’t follow the mandatory distribution guidelines. A financial professional is an excellent resource for guidance.

Citations

1. IRS.gov, September 23, 2020

2. NerdWallet.com, November 26, 2020

3. Internal Revenue Service IRA Required Minimum Distribution Worksheet, 2020