Understanding Money Market Funds

A money market fund, not to be confused with a money market account, is a type of mutual fund that invests in instruments like cash equivalents and short-term debt-based securities, which can also include U.S. Treasury Bonds.1

Safety First

These funds are designed to be easily accessible and are often considered cash equivalents. Their primary role in a portfolio is to preserve capital while maintaining liquidity. Financial professionals use them as a place to hold cash for an investor or as a place to “park cash” temporarily while they evaluate new investments. In fact, the core value of money market funds lies in their stability and liquidity, making them one place where investors can build an emergency fund.2

Asset Value

Money held in money market funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it is possible to lose money by investing in a money market fund.

Preserving Capital

Money market funds can play a role in an investor’s portfolio by providing a high-liquidity, low-risk investment choice that is designed to preserve capital. They can play a central role in managing an investment portfolio.2

Money market mutual funds are sold by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from your financial professional. Read it carefully before you invest or send money.

Citations

1. Medicare.gov, 2023

2. Medicare.gov, 2023

Buying A Vacation Home?

5 Questions To Consider First. If you and your family would like to call your favorite travel destination “home”, you may be considering purchasing a vacation property. This can be an exciting milestone, but there are a few things to consider first. Your financial professional might be able to provide you with some resources to help answer some of these critical questions.

- How will I use the home? Think about how often the home will be used—and by who. Will you be renting it out, can family come and stay when you’re not there, will it only be occupied a few weeks a year?

Did You Know…600,000 Americans use online marketplaces to rent out their property to vacationers.1

- Am I rushing this decision? When are you making the decision to buy a second home? Is it right after a relaxing vacation at a new location, or have you been considering this for a while? A second home is a large expense, you’ll want to avoid being impulsive when making your decision.

Tip: Travel to your desired location during each season to get a better feel for what it’s like all year round.

- Have I calculated the costs? Aside from the cost of the house, you’ll need to prepare to pay the ongoing costs of owning a second home. These include: Insurance, property taxes, maintenance, property manager (if renting) and HOA or amenity fees (if any).

- Are there rules about renting? If you plan on renting out your vacation home, check local laws and guidelines. Some places cap the number of days a home can be rented out or provide further restrictions on renting to vacationers.

- What will I do in an emergency? In some instances, an emergency might be a broken water heater or an electrical problem. In other instances, it may be more severe. What’s your plan? Would your home be within driving distance, or will you hire someone to check on it periodically throughout the year?

Did You Know…On average, the US is hit by 6 to 7 hurricanes a year.2

Citations

1. iPropertyManagement.com, July 14, 2022

2. Lll.org.2023

Catch-Up Contributions

A recent survey found that 18% of workers are very confident about having enough money to live comfortably through their retirement years. At the same time, 36% are not confident.1

In 2001 congress passed a law that can help older workers make up for lost time. But few may understand how this generous offer can add up over time.2

The “catch-up” provision allows workers who are over age 50 to make contributions to their qualified retirement plans in excess of the limits imposed on younger workers.

How It Works: Contributions to a traditional 401(k) plan are limited to $23,000 in 2024. Those who are over age 50 – or who reach age 50 before the end of the year – may be eligible to set aside up to $30,500 in 2024.3

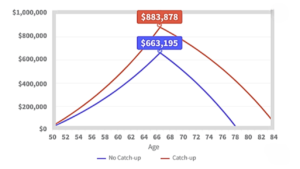

Setting aside an extra $7,500 each year into a tax-deferred retirement account has the potential to make a big difference in the eventual balance of the account, and by extension, in the eventual income the account may generate. (See chart)

Catch-Up Contributions and the Bottom Line: This chart traces the hypothetical balances of two 401(k) plans. The blue line traces a 401(k) account into which $23,000 annual contributions are made each year. The red line traces a 401(k) account into which an additional $7,500 in contributions are made each year, for a total of $30,500 in contributions a year.

Upon reaching retirement at age 67, both accounts begin making withdrawals of $7,000 a month.

The hypothetical account without catch-up contributions will be exhausted before its beneficiary reaches age 80. Keep in mind, the IRS regularly updates these maximum contribution limits.

Both accounts assume an annual rate of return of 5%. The rate of return on investments will vary over time, particularly for longer-term investments.

In most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 73. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty.

This hypothetical example is used for comparison purposes and is not intended to represent the past or future performance of any investment. Fees and other expenses were not considered in the illustration. Actual returns may vary.

Citations

1.EBRI.org, 2023

2.Economic Growth and Tax Relief Act of 2001

3.IRS.gov, 2024. Catch-up contributions also are allowed for 403(b) and 457 plans. Distributions from 401(k) plans and most other employer-sponsored retirement plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. In most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 73.