Have you ever been confused by the jargon used on Wall Street? Perhaps it is time to translate some of those esoteric stock market terms into plain English.

Blue chips: This term refers to stocks that have a history of consistently strong dividend payments, issued by large corporations with solid management. In addition, this is also a nickname for the Dow Jones Industrial Average, which includes 30 companies that usually deserve such a label.

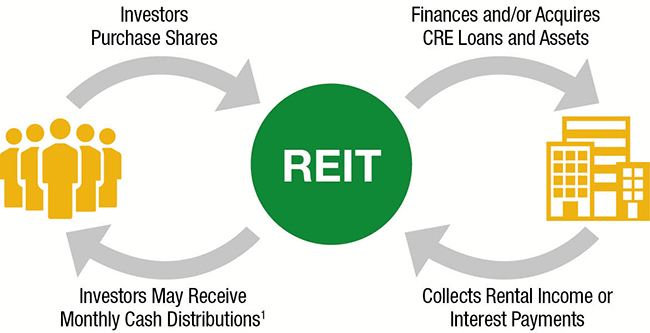

These investments let you own real estate without having to be a landlord.

What is a REIT? A real estate investment trust (REIT) is a real estate investment company that manages a portfolio of income properties, distributing the lion’s share of its profits as dividends. By getting into a REIT, you can gain an ownership interest in prime commercial real estate, without the headaches of commercial real estate management.

The Federal Reserve takes the key interest rate north by another quarter point.

On Wednesday morning, futures markets put the odds at 99.6% of a June interest rate increase by the Federal Reserve. Sure enough, the central bank made a move. It raised the key interest rate by 0.25%, taking the target range for the federal funds rate to the 1.00-1.25% range.

Expect more volatility, but avoid letting the headlines alter your plans.

Recent headlines have disturbed what was an unusually calm stock market. The political uproar in Washington may continue for weeks or months, and it could mean significant, ongoing turbulence for Wall Street.

The year of 2021 was wild, full of surprises and yet a historic one for the markets. Stocks overcame numerous headwinds, including a contested presidential election, an assault of the U.S. Capitol, historically high inflation, supply chain disruptions, the still raging global pandemic and the resurgence in COVID cases due to the new variants.

Equity returns for the last year and a half have been in a constant steady growth mode since the steep decline caused by the Covid-19 pandemic. The positive momentum continued in the beginning of the third quarter of 2021, with the broad market indexes reaching a series of all-time highs in July and August, powered by the resiliency of economic recovery and accommodative monetary policy of the Federal Reserve.

After an already strong start to the year, U.S. equity markets continued to post solid returns in the second quarter, thanks to the ongoing global vaccine rollout combined with fiscal support from the government. The S&P 500, a benchmark for large capitalization domestic companies, gained 8.6% for the quarter and was up 15.3% at the halfway point of the year.

The first quarter of 2021 was a turning point in both the pandemic in the United States and the economic damage it has caused. Stocks have not lost any of their luster from the end of last year. Despite a few episodes of heightened volatility, the equity markets marched steadily higher in the first quarter of 2021, with all the major indexes posting solid returns from high single to double digits.

The year of 2020 is mercifully behind us. It was a truly extraordinary year for the entire world and even more so for financial markets. The year started with the impeachment of an American President, followed by a pandemic that infected millions all over the world, a global recession which this pandemic caused, a bear market reminiscent of the financial crisis of 2008 and a level of social unrest that overshadowed the late 1960s – all of that unfolding against the backdrop of a presidential election, contentious to the point where fears of civil conflict were openly discussed.

The third quarter of a rather eventful 2020 saw the stock market’s continued recovery from the March lows earlier in the year. Equities climbed higher, with the broad U.S. indices soaring to new all-time highs before paring back some gains in September. Overall, it was the second consecutive quarter of notable market advances.

When the second quarter began, the stock market was just beginning to recover from one of the worst and quickest declines in history. By the end of June, U.S. stocks registered healthy gains, closing out a more upbeat quarter that saw strong advances across all equity markets. The S&P 500 Index posted its best quarter since 1998 with a 20.54% positive move, offsetting most of the pandemic-related drop from February’s highs to March’s lows.

Global stock prices suffered a sharp first quarter fall as the COVID-19 pandemic triggered a global economic shutdown. This pandemic-driven selloff, heightened by turmoil in the global oil markets, was unprecedented in its speed and severity. From February 19th to March 23rd, the U.S. stock market lost over 30% of its value.