Click & Download to read as PDF !

Should You Care What the Financial Markets Do Each Day?

Focusing on Your Strategy During Turbulent Times.

Investors are people, and people are often impatient. No one likes to wait in line or wait longer than they have to for something, especially today when so much is just a click or two away.

This impatience also manifests itself in the financial markets. When stocks slip, for example, some investors grow uneasy. Their impulse is to sell, get out, and get back in later. If they give in to that impulse, they may effectively pay a price.

Across the 30 years ended December 31, 2018, the Standard & Poor’s 500 Index posted averaged annual return of 10.0%. During the same period, the average stock mutual fund investor realized a yearly return of just 4.1%. Why the difference? It could partly stem from impatience.1

It’s important to remember that past performance does not guarantee future results. The return and principal value of stock prices will fluctuate over time as market conditions change. And shares, when sold, may be worth more or less than their original cost.

Investors can worry too much. In the long run, an investor who glances at a portfolio once per quarter may end up making more progress toward his or her goals than one who anxiously pores over financial websites each day.

Too many investors make quick, emotional moves when the market dips. Logic may go out the window when this happens, in addition to perspective.

Some long-term investors keep focus. Warren Buffett does. He has famously said that an investor should, “buy into a company because you want to own it, not because you want the stock to go up.2

Buffett often tries to invest in companies whose shares may perform well in both up and down markets. He also has famously stated, “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”2

In contrast with Buffett’s patient long-term approach, investors who care too much about day-to-day market behavior may practice market timing, which is as much hope as strategy.

To make market timing work, an investor has to be right twice. The goal is to sell high, take profits, and buy back in just as the market begins to rally off a bottom. But there is volatility in financial markets and the sale at any point could result in a gain or loss.

Even Wall Street professionals have a hard time predicting market tops and bottoms. Retail investors are notorious for buying high and selling low.

Investors who alter their strategy in response to the headlines may end up changing it again after further headlines. While they may expect to be on top of things by doing this, their returns may suffer from their emotional and impatient responses.

Nobel Laureate economist Gene Fama once commented: “Your money is like soap. The more you handle it, the less you’ll have.” Wisdom that may benefit your strategy, especially during periods of market volatililty.3

Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from your financial professional. Read it carefully before you invest or send money.

Citations

1 – nytimes.com/2019/07/26/your-money/stock-bond-investing.html [7/26/19]

2 – fool.com/investing/best-warren-buffett-quotes.aspx [8/30/19]

3 – suredividend.com/best-investment-quotes/ [12/5/18]

Key Provisions of the CARES Act

Distributions can be waived in 2020 for Inherited Accounts, 401(k)s, and IRAs.

Recently, the $2 trillion “Coronavirus Aid, Relief, and Economic Security” (“CARES”) Act was signed into law. The CARES Act is designed to help those most impacted by the COVID-19 pandemic, while also providing key provisions that may benefit retirees.1

To put this monumental legislation in perspective, Congress earmarked $800 billion for the Economic Stimulus Act of 2008 during the financial crisis.1

The CARES Act has far-reaching implications for many. Here are the most important provisions to keep in mind:

Stimulus Check Details – Americans can expect a one-time direct payment of up to $1,200 for individuals (or $2,400 for married couples) with an additional $500 per child under age 17. These payments are based on the 2019 tax returns for those who have filed them and 2018 information if they have not. The amount is reduced if an individual makes more than $75,000 or a couple makes more than $150,000. Those who make more than $99,000 as an individual (or $198,000 as a couple) will not receive a payment.1

Business Owner Relief – The act also allocates $500 billion for loans, loan guarantees, or investments to businesses, states, and municipalities.1

Your Inherited 401(k)s – People who have inherited 401(k)s or Individual Retirement Accounts can suspend distributions in 2020. Required distributions don’t apply to people with Roth IRAs; although, they do apply to investors who inherit Roth accounts.2

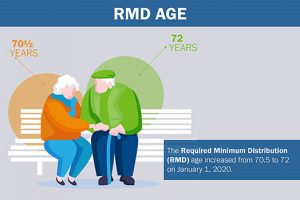

RMDs Suspended – The CARES Act suspends the minimum required distributions most people must take from 401(k)s and IRAs in 2020. In 2009, Congress passed a similar rule, which gave retirees some flexibility when considering distributions.2,3

Withdrawal Penalties – Account owners can take a distribution of up to $100,000 from their retirement plan or IRA in 2020, without the 10-percent early withdrawal penalty that normally applies to money taken out before age 59½. But remember, you still owe the tax.4

Many businesses and individuals are struggling with the realities that COVID-19 has brought to our communities. The CARES Act, however, may provide some much-needed relief. You can contact us to see if these special 2020 distribution rules are appropriate for your situation.

Under the CARES act, an account holder who already took a 2020 distribution has up to 60 days to return the distribution without owing taxes on it.

Citations

1 – CNBC.com, March 25, 2020.

2 – The Wall Street Journal, March 25, 2020.

3 – The Wall Street Journal, March 25, 2020.

4 – The Wall Street Journal, March 25, 2020.

This material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Updates for 2020