Why do so many people choose them over traditional IRAs?

The IRA that changed the whole retirement savings perspective. Since the Roth IRA was introduced in 1998, its popularity has soared. It has become a fixture in many retirement planning strategies because it offers savers so many potential advantages.

But when will the cryptocurrency bubble burst?

Investors are excited about bitcoin – perhaps too excited. Their fervor is easy to understand. On December 18, bitcoin closed at $17,566. Back on September 22, bitcoin was valued at only $3,603.1

Yes, you read that correctly – the price of bitcoin jumped nearly 500% in three months.

Have you been affected? If so, how can you try to protect yourself?

On September 7, credit reporting agency Equifax dropped a consumer bombshell. It revealed that cybercriminals had gained access to the personal information of as many as 143 million Americans between May and July – about 44% of the U.S. population.

If you’re going to say “I do,” here are some things you might want to do.

Are you marrying soon? Have you recently married? As you begin your life together, it is important for you to start planning your financial future together and putting your finances on the same page. Here are some priorities you might want to write down on your financial to-do list.

Have you ever been confused by the jargon used on Wall Street? Perhaps it is time to translate some of those esoteric stock market terms into plain English.

Blue chips: This term refers to stocks that have a history of consistently strong dividend payments, issued by large corporations with solid management. In addition, this is also a nickname for the Dow Jones Industrial Average, which includes 30 companies that usually deserve such a label.

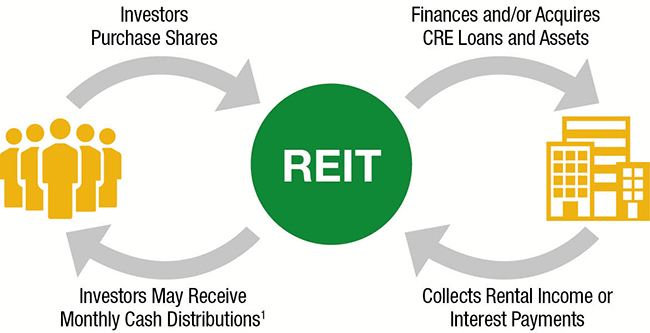

These investments let you own real estate without having to be a landlord.

What is a REIT? A real estate investment trust (REIT) is a real estate investment company that manages a portfolio of income properties, distributing the lion’s share of its profits as dividends. By getting into a REIT, you can gain an ownership interest in prime commercial real estate, without the headaches of commercial real estate management.

The Federal Reserve takes the key interest rate north by another quarter point.

On Wednesday morning, futures markets put the odds at 99.6% of a June interest rate increase by the Federal Reserve. Sure enough, the central bank made a move. It raised the key interest rate by 0.25%, taking the target range for the federal funds rate to the 1.00-1.25% range.

Expect more volatility, but avoid letting the headlines alter your plans.

Recent headlines have disturbed what was an unusually calm stock market. The political uproar in Washington may continue for weeks or months, and it could mean significant, ongoing turbulence for Wall Street.

With the discussions going on about how to address the deteriorating infrastructure and how to pay for it, here is a creative solution I sent to our local congressmen. Here is an idea how to spend $1 trillion on infrastructure and do it where the cost of money is zero. In fact the cost of the money would be less than zero.

On March 15, the Federal Reserve raised the benchmark interest rate by a quarter-point to a range of 0.75-1.00%. The increase was widely expected, and it represented a vote of confidence in the economy.1 This was the central bank’s second rate hike in three months, and Wall Street took it in stride, with the S&P